Candele LED A Cuore | 24 Pezzi | Senza Fiamma | Per San Valentino, Matrimoni E Eventi Romantic

Disponibile

Disponibile

€ 8

AGGIUNGI AL CARRELLO

Consegna

- Corriere espressoda martedì 30 dicembreGRATIS

Venduto e spedito da ePRICE

Altri 21 venditori a partire da € 9

- Informazioni legali

- Ne hai uno da vendere?

- 434989

- 63738719339

Pensati per Te

Prodotti simili

Descrizione

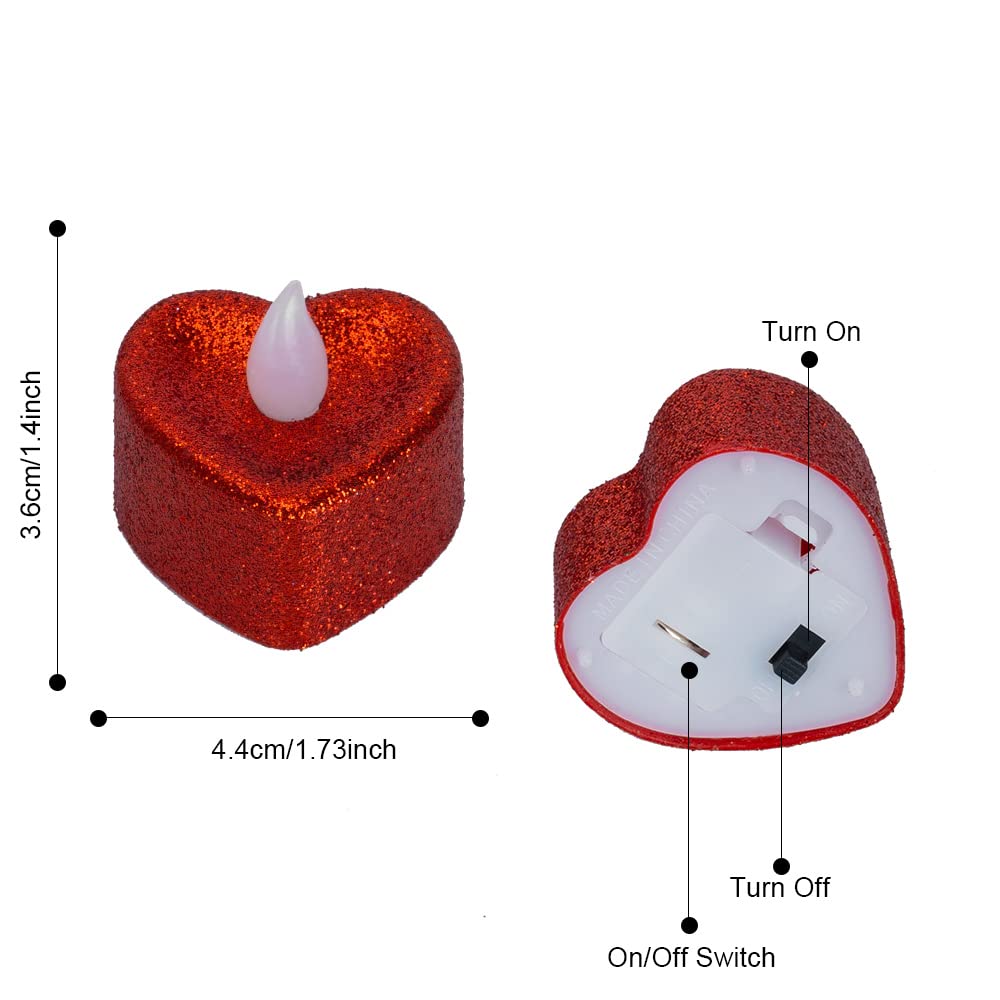

Queste candeline LED a forma di cuore sono perfette per creare un'atmosfera romantica! Il set include 24 candele, ognuna di circa 4cm di diametro, con una luce calda e realisticma senza fiamma. Sicure, niente cera o rischio incendio, e durano fino a 150 ore. Si accendono con un pulsante sulla base e i petali si aprono per un effetto decorativo. Ideali per San Valentino, proposte di matrimonio, anniversari, matrimoni o cene speciali. Decorano tavoli, camere o qualsiasi evento. Un regalo romantico e pratico che impressiona sempre!Caratteristiche e scheda tecnica

Caratteristiche principali

- EAN1213111296432

Recensioni

2025-12-28 | 59fulaa